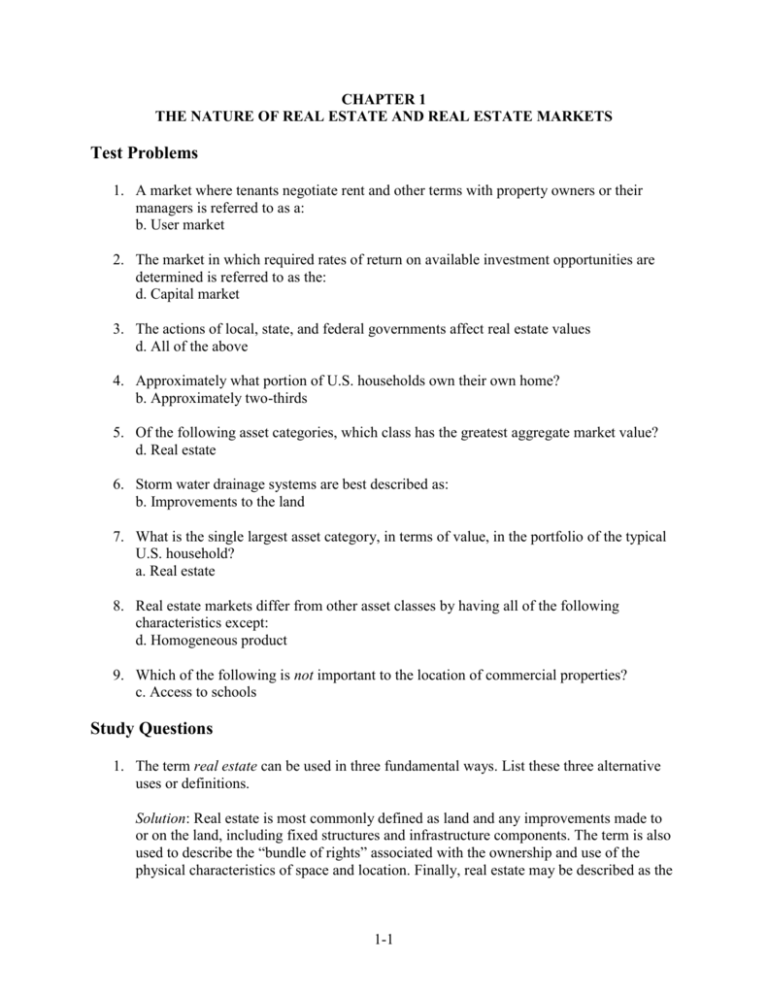

A Household's Net Worth or Equity Is Best Described as

The financial net worth is calculated as the ratio of financial net worth of households divided by the number of individuals in the country in United States dollars at current purchasing power. Household total net worth represents the total value of assets financial as well as non-financial minus the total value of outstanding liabilities of households including non-profit institutions serving households.

Wealth Net Worth Patterns Trends

Household net worth or wealth is an important part of economic well-being in the United States.

. Household net worth increased by 53 trillion or 37 after a more moderate gain in the third quarter a Federal Reserve report showed Thursday. Net worth is a generic term. For example if you have 100000 in home equity you may have access to an 85000 loan.

Which of the following best describes a general journal. The households net worth. Households equity allocation hits record highs.

Personal equity Net worth The concept of equity applies to individual people as much as it does to businesses. The owners interest or worth in the busines. Net worth is relevant when we are only talking about an individual or a company that has no separate identity from hisher.

2019 Detailed Tables Wealth of Households. Usually in your list of assets you include cash retirement funds investments etc. In other words it is the actual propertys current market value less any liens that are attached to.

The value of real estate held by households rose by 15 trillion and the. The market price of that home determines its value but it may have a claim against it in the form of a mortgage loan. The fourth-quarter advance pushed net worth to more than 150 trillion.

1-Year Implied Volatility vs. The households liabilities minus its assets D. The rate of job destruction is 2 per year and the rate of job creation is 1 per year.

The difference between the value of the house and the amount. We all have our own personal net worth and a variety of assets and liabilities we can use to calculate our net worth. Furniture and household items.

A home equity loan allows you to borrow money that is secured by your home. Home equity is the value of a homeowners interest in their home. What is household equity.

Equity is determined one at a time. Does valuation still matter. Quarterly Q4 1945 to Q4 2021 Mar 17.

What is household equity. The net worth of a household depends on the types of assets it owns the value of those assets and the claims on those assets. Net worth is how much a companyan individual has after paying off the liabilities.

There is equity in everything not just a home or a car. Global Equities Flows 04302022 Off. Millions of Dollars Not Seasonally Adjusted.

Owners Equity in Real Estate Level OEHRENWBSHNO from Q4 1945 to Q4 2021 about net worth balance sheet nonprofit organizations equity real estate Net households and USA. Please note that this indicator only takes into account the value of dwellings and not other types of non-financial assets. Fed Funds Target Rate 02192022 Off.

What could go wrong as US. The SP 500s Shiller CAPE ratio is approaching its highest level on record. Household financial net worth is the balancing item of their financial balance sheet recorded at current market values.

On this page you will find wealth statistics for various demographic and socioeconomic groups. Households and Nonprofit Organizations. You may be able to borrow up to 85 of the equity you have built up.

The households net worth. Shareholder equity has a definite meaning. In an imaginary economy GDP falls from 100 billion to 95 billion while output per worker rises from 5000 to 5020.

Owners equity also referred to as net worth equity or net assets is the amount of ownership you have in your business after subtracting your liabilities from your assets. The reality is that both equity and net worth are not just defined interms of money even though most people look at the terms and theresults that way especially accountants and bankers. Though net worth is synonymous to equity in a business it sometimes is used in different contexts.

Household Equity Ownership as of Net Worth vs. The actual amount you are offered will also be based on factors such as income credit score and the homes. Net worth canbe the sum of many equity items.

2017 SIPP News Press Release March 01 2022. For example the typical American household owns a home. Common examples of personal assets include.

The fourth-quarter advance pushed net worth to. Athe market value of the assets employed by the firm. The total net worth is measured as a percentage of net disposable income.

None of the above. Household Equity Ownership as of Net Worth vs. Other Components of Net Worth Excluding Real Estate and Direct and Indirect Holding Holdings of Corporate Equities and Debt Securities Level.

Net worth can be described as either positive or negative with the former meaning that assets exceed liabilities and the latter that liabilities exceed assets. Net worth is defined as assets minus liabilities. Both a and b above.

The households assets minus its liabilities. Graph and download economic data for Households. For instance it is more typical for someone to say The net worth of company XYZ is 50000 than to say The owners equity of company XYZ is 50000 Individuals may also refer to their own assets and liabilities differential as personal.

Shareholder equity is relevant when the company has multiple owners. The households assets minus its liabilities. In this economy there has been.

Fear Greed Index Investor Sentiment 04302022 Off.

Solved Question 2 1 5 Pts A Household S Net Worth Or Chegg Com

Household Balance Sheet Of The Sample And Of Households With A Negative Download Table

No comments for "A Household's Net Worth or Equity Is Best Described as"

Post a Comment